As cryptocurrency continues to gain global momentum, digital fraudsters and scammers have resorted to methods like phishing and business impersonation, amongst others, in order to perpetuate cryptocurrency scams and defraud people.

Digital fraud is a big problem in the cryptocurrency space. In 2021, over $7.7 billion in cryptocurrency was stolen from individuals and services through scams, according to Chain Analysis.

Brand impersonation is a significant problem for blockchain and web 3.0 businesses because not only does it lead to a loss of potential customers and source of revenue, it also damages your brand’s reputation and visibility as well.

In this article, we talk about:

- What crypto scams are

- How to identify and report crypto scams

- Examples of Crypto Scams

- How Red Points can help protect your brand against crypto scams

What are crypto scams?

A scam is traditionally defined as a fraudulent scheme performed by a dishonest individual, group, or company in an attempt to obtain money or something else of value. Cryptocurrency scams are plots or tricks cybercriminals use to exploit innocent crypto investors and drain them of their funds.

Ever since the advent of cryptocurrency, scams have become a widespread and recurrent problem in the space. In 2021, scammers and hackers made off with an estimated $14 billion from innocent investors.

Although the industry is growing rapidly and significant players in the industry are attempting to solve these problems as quickly as possible, Cryptocurrency possesses several inherent features that make it easy for scammers to operate.

Firstly, cryptocurrencies are decentralized, and although this is regarded as a net positive, it also means that there is no centralized or governmentally empowered authority to manage it or to stop fraudulent transactions before they occur.

Secondly, cryptocurrency transactions are typically irreversible after confirmation. This means any funds or coins mistakenly sent to a fraudster or scammer is now out of your hands, usually, for good.

Unfortunately because cryptocurrency transactions are relatively new, many people are still not familiar with the transaction process or how it operates. This makes it easy for scammers to do their business.

Finally, the cryptocurrency industry is laden with many success stories of investors multiplying their equity several folds after investing in a crypto or buying select coins and tokens very early on. Crypto scammers prey on the hype and “mania” of these past token success stories to lure innocent investors into scams, investment traps, and even Ponzi schemes solely designed to enrich only themselves at the cost of their victim.

Examples of crypto scam

Scams involving cryptocurrencies are wide and varied. Here are some categories:

1. Malware scams

These scams involve targeted efforts to gain access to a digital wallet or login credentials through cyber attacks and malware. To put it another way, con-artists attempt to obtain information that will grant them access to a digital wallet or other forms of private information. This can range from things like private keys to wallet PINs, which end up being stolen through sophisticated ransomware, such as malicious bots and viruses that are often sent via e-mails and text messages.

2. Social scams

These scams are more social in nature. This is when a scammer attempts to trick innocent investors into unknowingly sending cryptocurrencies to them through impersonation, false investments or business offerings, or other deceptive practices. These scams are also often referred to as social engineering scams.

For social engineering schemes, con-artists utilize psychological manipulation and deception to access sensitive user account information. It is common for scammers to make individuals believe they are interacting with a trusted entity like a government agency, a well-known business, or even a representative from tech support.

Scammers will often work from any angle or take as long as they need in order to build the trust of a potential victim so that they divulge critical information or send money to the scammer’s digital wallet.

Additionally, it is usually a red flag when a trusted business partner customer suddenly begins to request payment in cryptocurrency out of the blue. More often than not, they are being impersonated by a scammer that thinks you take the time to question them.

3. Impersonation scam

According to the United States Federal Trade Commission, cases of frauds involving the impersonation of businesses and government officials resulted in reported crypto losses of $133 million in 2021.

Impersonation scams can occur in many different ways. Although the specific format used can be tweaked from time to time, the end game for these scammers is always to get you to transfer your funds from your account to their own.

4. Giveaway and imposter scams

Scammers also impersonate celebrities, businesses, and even social media bitcoin influencers. In what is known as a giveaway scam, many con-artists boldly claim that they will double, or even triple, any amount of bitcoin that is transferred to them in order to attract the attention of potential victims.

Messages from what appears like a reputable social media account can generate legitimacy and

urgency, which could inspire a false sense of trust from unsuspecting victims.

The idea that this is a “once in a lifetime” opportunity can convince some people to move their money around hastily in the expectation of a high return right away without taking the time to do proper due diligence.

5. Phishing scams

Phishing scams are used to collect innocent individuals’ online wallet information and login credentials. Scammers are particularly interested in the private keys associated with cryptocurrency wallets since these are the only keys that can be used to access the funds stored within those usually secure digital wallets. Their operation is very similar to that of a standard phishing internet scams.

The scammers will send an email containing a link that, when clicked on, will direct you to a fake specialized website where you will be prompted to enter your private wallet login information. After obtaining this info, the scammers will immediately proceed to drain your wallet of funds.

Although this format is quite simple, phishing scams are becoming incredibly sophisticated, as scammers are going to incredible lengths to create fake websites that, at first glance, look exactly like the real thing.

How to report crypto scams

If you or your business has fallen victim to a cryptocurrency scam, the first and most important action step is to file a complaint as quickly as possible with relevant authorities as well as notify the cryptocurrency exchange you were scammed on. It is advised you do this as fast as possible as cryptocurrency scammers are notorious for quickly moving funds off cryptocurrency platforms and out of the reach of investigators.

The authorities to which you should report cryptocurrency fraud to may differ from region to region, but all cryptocurrency fraud complaints should generally contain the following pieces of information:

- Your Personal Information (name, address, telephone, and email).

- Any information or details about the scammers or the person receiving the funds.

- Transaction IDs.

A transaction ID, also known as a TXID, is a one-of-a-kind string of letters and numbers used to indicate a record of cryptocurrency transfer from one address to another. It is also known as the transaction hash. The hash indicates the date and time, the sending and receiving addresses, the transaction amounts, the fees, and more.

To properly track your stolen funds, investigators will need all of the transaction IDs that identify the funds you sent to the scammers. By using transaction IDs, authorities can electronically identify and track the stolen coin’s transfer history and current location.

- Specific details on how you were victimized.

- Proof of ownership of the stolen funds.

- Any other relevant information you believe is necessary to support your complaint.

- Your digital signature (no pseudonyms).

For brands and businesses based in the United States, you can go to your local police station to lodge a complaint. You can also choose to report your case to the following authorities:

- The Federal Trade Commission (FTC)

- The Commodity Futures Trading Commission

- The U.S. Securities and Exchange Commission (SEC)

- The Internet Crime Complaint Center (IC3)

For European-based businesses, Europol is a helpful resource for finding the appropriate and relevant authorities to report crypto fraud. Europol recommends visiting your local police station to file a complaint if your Member State does not have a dedicated online option.

How to identify crypto scams

Like all internet scams, the success of a crypto scams often relies on the guile of the scammer, but can be thwarted with proper and consistent vigilance.

Cryptocurrency scammers continually look for new ways to seperate you from your money.

Here are things to note to avoid falling victim to a crypto scam:

Only con artists will insist on being paid exclusively in cryptocurrencies. Although crypto payments are starting to become popular payment options, most legitimate brands and businesses often offer alternative payment options for customers.

If you’re looking to buy something or pay for a service through crypto, be wary of any business that asks you to send cryptocurrency in advance. You have the right to be suspicious in these instances because they are often scams and they may cut off communication as soon as funds are transferred.

Although, as earlier stated, crypto is well known for success stories, scammers will often promise enormous returns or profits quickly for investing with them in a certain project. Do not believe anyone who claims that you can make money in the crypto markets quickly and effortlessly “just” by investing in a particular project. This is likely a ploy to drain you of your funds.

What’s next

Brand impersonation by scammers is a significant challenge for blockchain and crypto businesses.

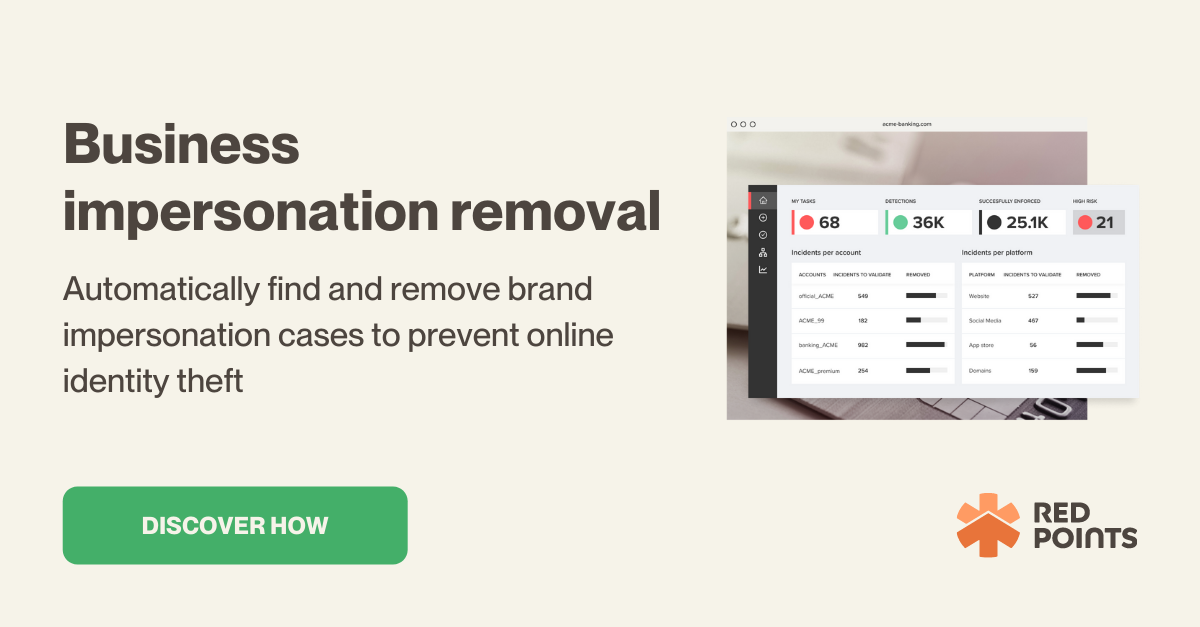

To avoid being impersonated, it is often advised you take a proactive approach to safeguard your business. Red Points can help you protect your brand from being impersonated by these bad-faith actors.

Check out Red Points’ Business Impersonation Removal tool to learn how it can protect your business against crypto scams.