The cryptocurrency industry is a fast-growing one. With over 10,000 cryptocurrencies in existence and a market cap of $2.9 trillion dollars at its peak, the cryptocurrency industry is the newest and one of the most rewarding investment frontiers for brands and businesses.

That being said, being invested in crypto certainly comes with its own unique challenges. Scams, fake cryptocurrencies, and rugpulls are seemingly common occurrences. These are some of the prominent dangers that can result in a loss of revenue for investors; so brands and businesses looking to invest in the space must be aware of them before entering the space.

As the cryptocurrency industry continues to gain momentum and expand, methods and measures to fight against crypto fraud are continuously being developed and improved upon.

This guide intends to educate users on what is fake crypto and how to avoid it.

In this article, we discuss:

- How cryptocurrency works

- What are fake crypto tokens

- How to identify and avoid fake cryptocurrencies

- How Red Points can help protect your brand against crypto scams

What is crypto?

As the name implies, cryptocurrency is essentially digital money. It functions just like regular money, except in a digital space; a cryptocurrency is an online peer to peer medium of exchange anyone can use to buy or sell goods or services and enable payments.

The word “crypto” stands for cryptographic because all cryptocurrencies use a cryptographic encryption to confirm, verify, and secure transactions, and “currency” for money.

Unlike regular money, however, cryptocurrencies are not controlled, regulated, or owned by any central authority, i.e, they are decentralized. The price of a crypto token is solely determined by the supply and demand for the cryptocurrency itself.

Although, because cryptocurrencies are not backed by any government, they have no legal protection. This means that losses incurred from trading or owning shares of a crypto currency cannot be refunded or written-off on tax documents like some losses from stocks can be.

How does crypto work?

Cryptocurrencies primarily run on blockchain technology. Blockchain is an innovative technology that eliminates the need for a third party intermediary between buyers and sellers. A blockchain can be thought of as an electronic database that holds information in a digital format.

The purpose of Blockchain is to enable digital information to be recorded and distributed, but not edited after it has been distributed. In this sense, a blockchain serves as the basis for immutable ledgers, acting as a record for transactions that cannot be modified, deleted, or destroyed. Because of this, another name for blockchain technology is distributed ledger technology (DLT).

Blockchain technology is the life wire of every cryptocurrency system. They play a crucial part in the process of keeping a record of transactions that is both secure and decentralized

How to spot fake crypto?

Although dozens of cryptocurrencies launch every day, not all cryptocurrencies are created equal.

Unscrupulous individuals often take advantage of the anonymous and decentralized nature of the crypto space to mint tokens solely designed to drain ignorant investors of their funds and enrich them instead. This is a type of cryptocurrency scam known as a rug pull.

A rug pull is a form of cryptocurrency scam that occurs when fraudulent developers establish a new crypto token, artificially inflate its price, and then attempt to extract as much value from the tokens as they can before they exit, leaving their investors with an asset that has no value. This type of scam is also known as “pump and dump.”

According to data from Chainanalysis, rug pulls drained investors of more than $2.8 billion worth of cryptocurrency and accounted for over 37% of all cryptocurrency scams committed in 2021.

Although unscrupulous individuals attempt to rug pull investors in many different ways, there are classic tell-tale signs that signal a project might be a rugpull.

One such signal is the promise of unsustainably high yield with no clear, detailed explanation of where the money might be coming from. Another potential signal of a rug pull project is if it has not been audited by a reputable third party code auditor.

External independent code auditing are standard best practices in the crypto space. Third party code auditors scan through the actual code of the project to check for any malicious code bug or software vulnerability that might be exploited later by the developers.

Before investing, it’s worth taking the time to research new cryptos and to do due diligence, to avoid being a victim of fake cryptocurrency scams.

How to avoid fake crypto

Identifying and avoiding fake cryptocurrencies is only possible through research and doing due diligence. Here are some ways to investigate crypto ventures and ensure they are legitimate:

Investigate the team behind the project

The team behind a cryptocurrency is extremely important in determining the project’s overall success.

The cryptocurrency field is dominated by prominent names, and well known individuals are often able to make or break new projects simply by having their names included on the development team. For this reason, scammers and creators of fake cryptocurrencies often create false founders and biographies.

Before you put money into a venture, doing in-depth due diligence on the people who will be working on it is your greatest line of defense against fraud.

You should be wary if you can’t locate any information on a developer or founder on LinkedIn or other social networking sites. Even if profiles do exist, it is important to determine whether or not their activity seems to correspond with the amount of followers and likes they accumulate. Individuals with little to no activity amassing thousands of followers may be fake.

Examine the whitepaper in great detail

The whitepaper for a cryptocurrency project is the document that serves as the project’s foundation. The whitepaper should outline the project’s background, aims, strategy, concerns, and the estimated timeframe to achieve its goals and objectives.

Whitepapers reveal the core aims and objectives of a project. They have the potential to be extremely revealing; for example, you may discover that a project with a very visually appealing website does not have a fundamentally good concept.

Whitepapers are an extremely important resource, and businesses that don’t provide them should be avoided at all costs.

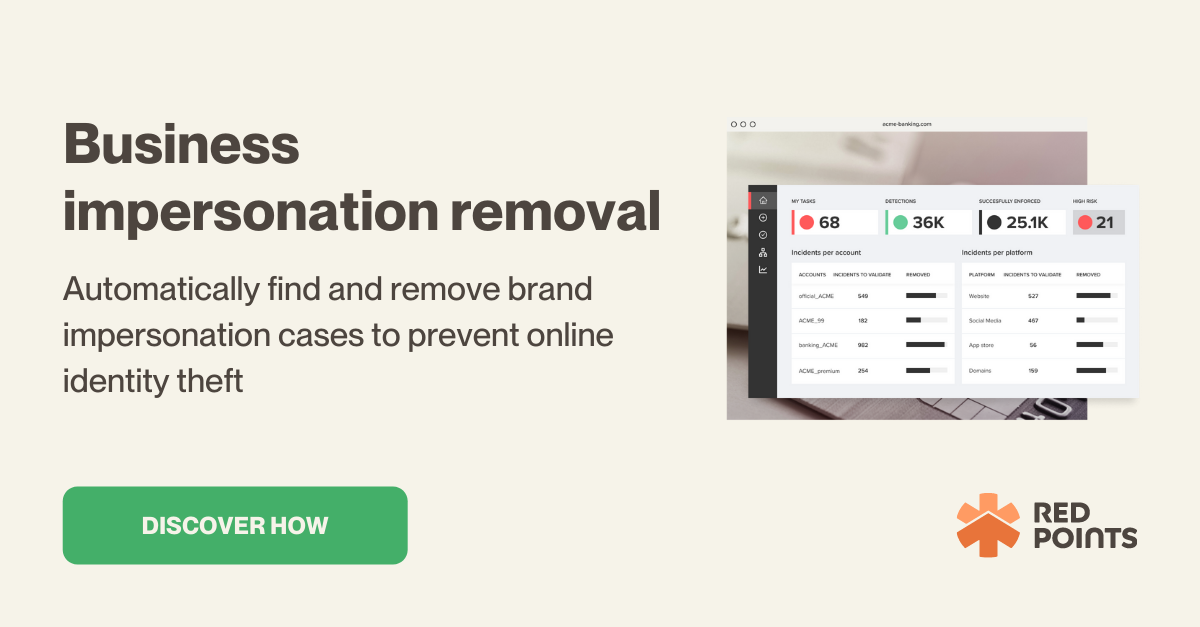

Protect your business from impersonators

For companies with a web 3.0 presence, it is not uncommon for bad actors to create a fake token impersonating as your business in order to scam potential prospects and ignorant investors. This can damage your reputation and affect the success of your company.

To protect your business, you can opt in for a Impersonation Removal Software like Red Points‘.

What’s Next?

Rugpulls and fake cryptocurrencies constitute a serious problem to the cryptocurrency industry as a whole.

Not only do they result in a loss of revenue, the reputation of brands and businesses impersonated by scammers are affected as well. Red Points can help you protect your brand from being impersonated by these bad faith actors.