The increasing reliance on mobile finance apps by consumers worldwide has made them prime targets for cybercriminals. In 2020, mobile banking usage in the US soared by 50%, and that number is only set to increase.

This surge has brought a parallel rise in mobile banking fraud attempts. As the world of mobile finance continues to expand, businesses operating in the fintech space must stay one step ahead to protect their mobile finance apps from cybercriminals and malicious actors.

In this article, we will discuss:

- What mobile finance app scams are and how much they matter

- Examples of mobile app finance scams

- How to protect your mobile finance app from cyber criminals

- How Red Points can help enhance your mobile finance app protection and keep your customer’s sensitive information safe

Are mobile finance app scams a big problem?

With millions of people using mobile finance apps to manage their money and perform transactions, scammers are increasingly targeting these apps to exploit users’ sensitive information and steal funds.

In recent years, the number of mobile finance app scams has risen significantly. This poses a significant threat to the security and reputation of mobile finance brands and app businesses.

What are some examples of mobile finance app scams?

Examples of mobile finance app scams can include:

Fake mobile finance apps

Scammers create fake apps that resemble legitimate mobile finance apps to trick users into downloading them. Once installed, these fake apps can harvest users’ sensitive information or spread malware. These apps may also contain hidden fees or unauthorized charges that can quickly drain a user’s account.

Phishing attacks

Fraudsters send phishing emails or text messages to mobile finance app users, urging them to click on malicious links or download attachments. These tactics often lead to compromised login credentials and unauthorized access to users’ accounts. In some cases, scammers may even use social engineering techniques to impersonate bank representatives, convincing users to divulge sensitive information.

Unauthorized transactions

Scammers exploit security vulnerabilities in mobile finance apps to perform unauthorized transactions, often resulting in financial losses for the users and damage to the reputation of the finance business. This can include transferring funds to fraudulent accounts, making unauthorized purchases, or even taking out loans in the user’s name.

Account takeover attacks

By gaining access to a user’s login credentials, scammers can take over the account and perform various malicious activities. This includes changing the account’s contact information, making unauthorized transactions, selling their personal data online, and even locking the legitimate user out of their account.

What is mobile finance app protection?

Mobile finance app protection refers to the security measures that finance businesses can implement to safeguard their mobile finance apps from scams and fraudulent activities.

Mobile app protection includes proactive measures such as:

Copyright protection

Copyright protection is particularly important for mobile apps, as they often contain original works of authorship such as code, graphics, and audiovisual content. Copyright law protects your app from unauthorized copying or distribution by third-party actors once registered.

Mobile app developers should be aware that copyright law varies from country to country and that they may need to obtain copyright protection in multiple jurisdictions, although in most places, including the EU and USA, copyright is automatically granted upon creation.

Additionally, it’s important to ensure that your mobile app doesn’t infringe on anyone else’s copyrighted material.

With a properly registered copyright, you can pursue any third party who infringes and makes copies of your mobile finance app and establish legal protection against unauthorized copying, distribution, or adaptation.

Trademark Protection

Trademark protection is also an important intellectual property security measure for mobile finance apps. A trademark is a word, phrase, symbol, or design that identifies and distinguishes the source of goods or services from those of others. In the context of mobile apps, trademarks may protect the name, logo, or other branding elements associated with the app.

To obtain trademark protection for your mobile app, you need to file a trademark application with the relevant government agency in each country where you want protection. The trademark application process is typically handled by a lawyer or trademark attorney.

In addition to filing applications, you should also use your trademark in commerce, meaning that you must actually use the mark in association with goods and services to obtain trademark protection.

Once your mobile finance app is registered as a trademark, it can be used to deter potential infringers and make it clear that your company owns the rights to the mark.

If you believe that a third party is infringing on your mobile finance app trademark, you should contact them as soon as possible and demand they cease using the mark in question. If they refuse to comply, you may need to take legal action against them in order to protect your rights.

Two-factor authentication

Two-factor authentication (2FA) is an FBI-recognized security measure to protect accounts against unauthorized access.

In 2FA, the user must provide two different forms of identification (e.g., username & password and one-time code sent via text message or email) in order to access the app. This makes it much harder for fraudsters to gain access to the app and ensures that only authorized users can access it.

2FA also helps protect against account takeovers – if a fraudster attempts to log in with stolen credentials, they still won’t be able to get past the second form of authentication. For this exact reason, many businesses have begun implementing these security protocols into their platform as a standard process for their users, rather than an optional service.

Multi-Factor Authentication (MFA)

Business owners should also consider implementing multi-factor authentication (MFA) for additional security.

MFA requires users to provide multiple forms of authentication, such as a code sent via text or email, biometrics like fingerprints or facial recognition, or physical tokens such as hardware keys. This makes it even more difficult for fraudsters to gain access to the app and ensures that only authorized users can access it.

Secure communication

Ensuring that all communication between the mobile app and business servers takes place over secure channels can help prevent man-in-the-middle attacks and other forms of data interception.

However, it is also important to educate customers on this matter so that they are aware that anyone who reaches out to them asking for personal information is a scam. Even if your business does use secure communication channels to communicate with customers, without educating them about this feature, you still run the risk of them being targeted by scammers.

Security updates

To further prevent a security breach, frequent security updates should be applied to your mobile app. These updates should help to patch any vulnerabilities in the app that have been detected and ensure that it remains secure from unauthorized transactions and other forms of fraud.

Use a mobile app protection software

Mobile app protection software can help businesses detect malicious activity and unauthorized access to their mobile apps. It provides an added layer of proactive security that can help protect the company from potential threats and revenue loss.

For example, Red Points’ Mobile App Protection software is a digital software solution that can detect if fake or pirated copies of your finance app are being made and distributed on app stores and taken them down.

With this additional layer of protection, businesses can protect their apps from cyberattacks and other forms of malicious activity.

By implementing these measures, you can ensure the safety of your customer’s personal and financial information.

How can Red Points assist with mobile finance app protection?

Red Points offers a comprehensive Mobile Finance App Protection solution that helps finance businesses secure their mobile finance apps and protect their customers from scams and fraudulent activities. By partnering with Red Points, financial businesses can benefit from the following services:

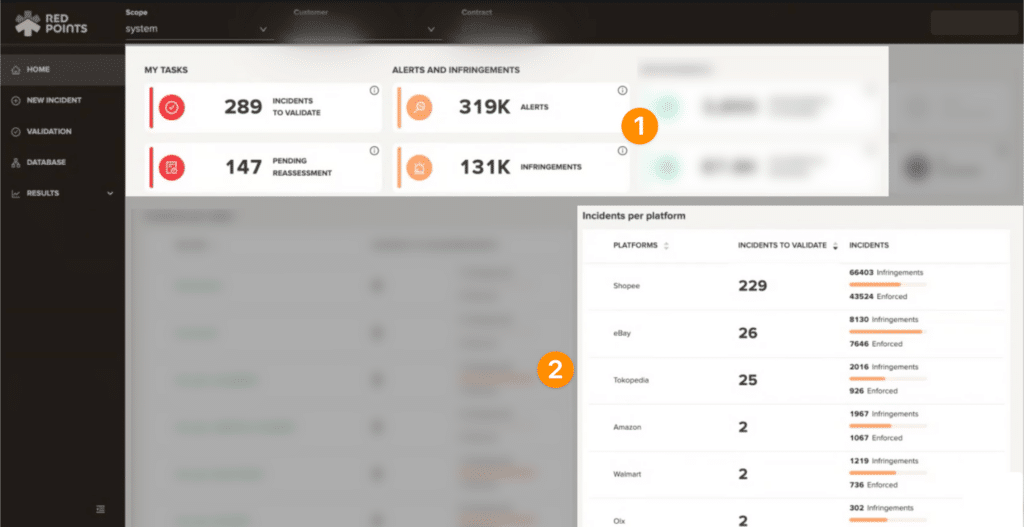

Automated monitoring and detection

Red Points’ Anti Piracy Solution boasts advanced technology features machine learning technology that uses bot-powered searches to detect potential infringement. As a result of the AI machine learning process built into our platform, our detection becomes increasingly accurate over time, which means that you can spend less time worrying about fake apps and more time shutting them down.

Reviewing and validating

While our detection process is completely automated, the next step, validation, is actually dependent on the action taken by the platform’s user, you. This step is where our users review all the potential infringements we’ve detected and can decide whether or not to have them taken down.

Fortunately, to make the manual nature of this step easier, we offer smart rules that our users can set up which can automatically validate infringements we’ve detected that have certain characteristics, meaning that any guaranteed infringements we detect can be taken down immediately.

Takedown and enforcement

Once the users have positively identified and validated an infringement from the list of detections on our platform, the final stage of the process is automatically initiated, which is enforcement.

This stage is where we enforce your rights as an intellectual property owner to have the infringement taken down, whether it be a fake mobile app, a modded version of your mobile app, or other scams that put your mobile app and its users at risk. This process is handled entirely by Red Points, from initiating the takedown and following through until the infringement is removed.

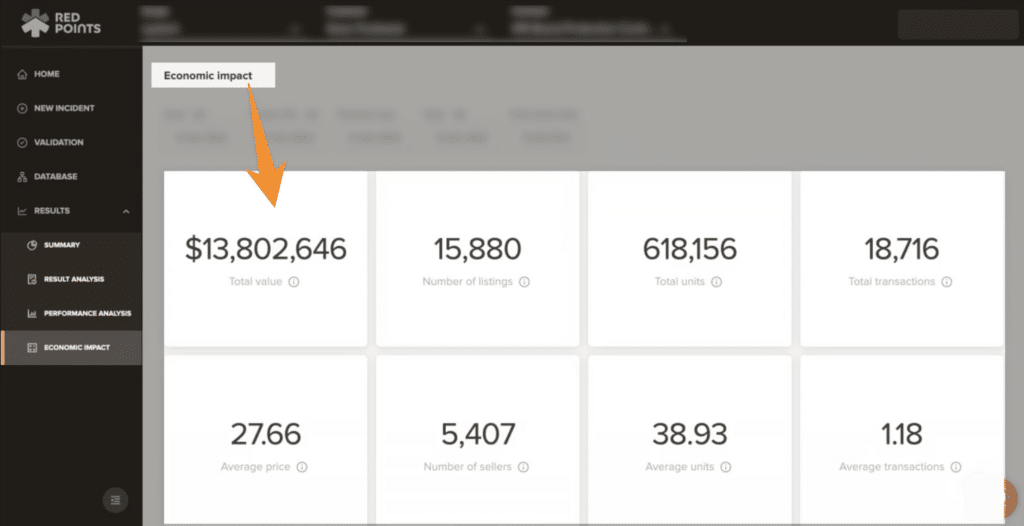

Data reports and detailed insights

On top of the protection that Red Points’ Mobile App software provides, it also presents its users with detailed reports composed of all the data we collect while monitoring for potential infringement. This data provides powerful insights that can allow your business to adopt the best strategy to maximize your mobile apps’ value and ensure its users are safe from harm.

These data reports can be tailored to the needs of each business and can even provide economic impact calculations that will tell you how much revenue you’ve been able to save as a result of using Red Points.

What’s next

As mobile finance app scams continue to grow in prevalence and sophistication, finance businesses must take proactive steps to protect their customers and secure their mobile finance apps. The cost of inaction can be significant, leading to financial losses, customer distrust, and long-term damage to your business’s reputation.

By implementing robust mobile finance app protection measures like Red Points’ Mobile App Protection software, finance businesses can stay ahead of the threats and minimize the impact of scams on their customers and their brand.

If your business’s mobile finance app is not being proactively monitored and protected, consider speaking to one of our Anti Piracy experts to learn how we can help your business specifically.